Why Discount Grocery Stores Are Adopting Frictionless Checkout

The idea that discount grocery stores are only for the low-income shopper is a thing of the past. Between the more broad, quality offerings that most discounters offer today and the transformation from cramped, old-school stores to modern and efficient ones, wealthier, upper-class shoppers are now a huge proportion of discount grocery customers. According to Business Insider, one of the top 100 favorite brands by millennials is Aldi, yes – a discount grocery retailer, ahead of brands like Lululemon and Tesla. This points to the fact that discount is important across the board, even for millennials who also picked Apple as their favorite brand, which we all know has a hefty price tag on their products.

One of the retailers that ushered in this change is Trader Joe’s, which opened its doors in 1967 and was bought by now-discount grocery retail giant, Aldi Nord in 1979. Trader Joe’s unique, high-quality items at a low price are one of the main reasons behind its rapid growth and preference over more expensive competitors like Whole Foods.

Discounters come in different formats that enable them to drive down prices. The most ubiquitous form is the Trader Joe’s and Aldi model of private label brands. By buying directly from manufacturers themselves, they are able to provide shoppers with a lot of variety at a low price under their private label. While brand selection may be impacted, the overall product range and low prices are enough to make up for it.

Not only that, but today, grocery retailers’ private labels are no longer just a way to save money but are recognizable, trusted, and even preferable brands. Take Costco’s private label ‘Kirkland,’ for example. It not only makes up a striking 27% of Costco’s total sales, but it is also one of the main draws for shoppers to purchase a membership.

Discounters started stepping up – and reaped the benefits

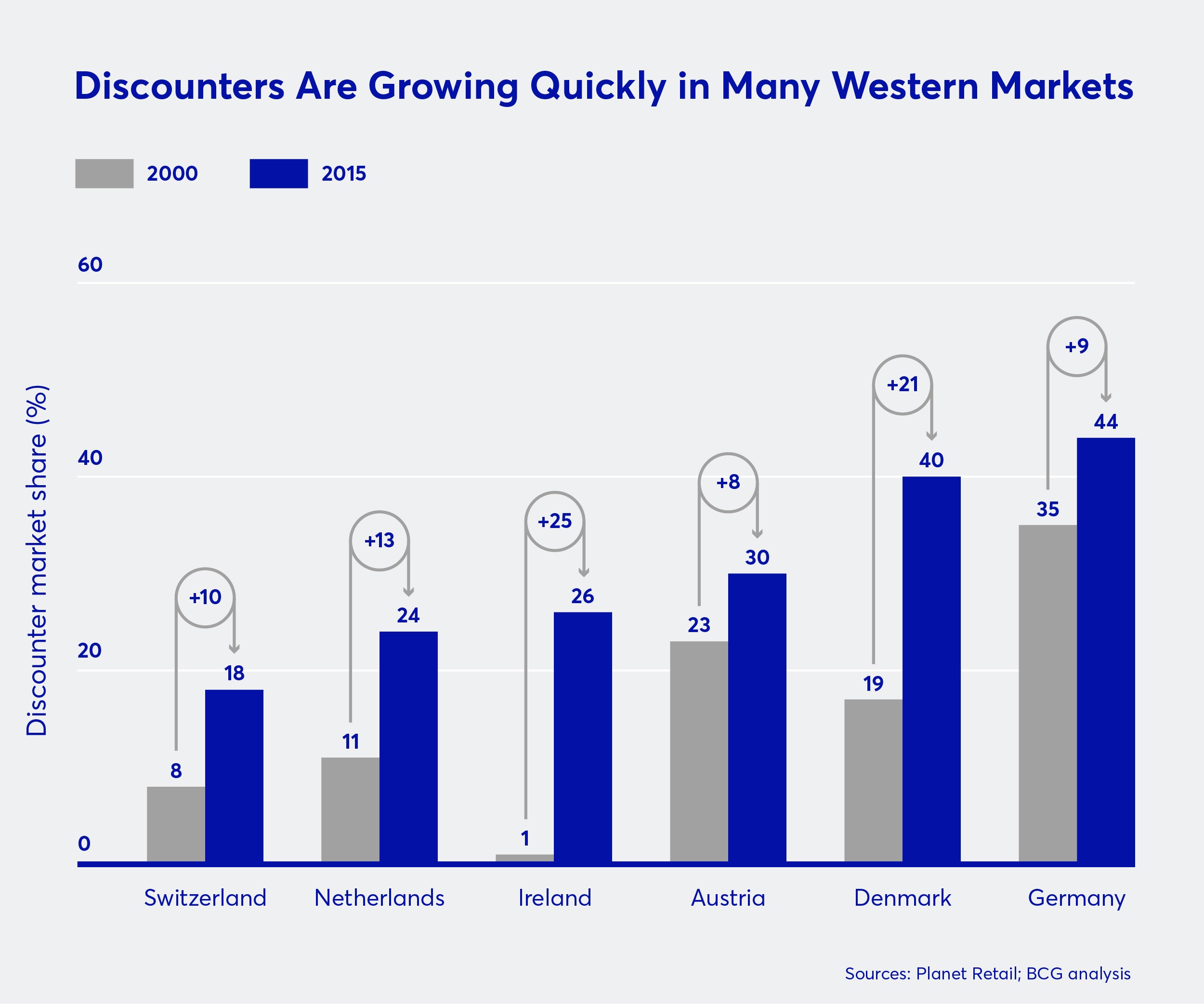

Discounters used to have their niche of budget shoppers, taking up anywhere between 10-20% of the grocery market share – something mainstream grocers would normally accept and overlook. However, according to BCG, between 2000 and 2015 there was a large jump, especially in countries like Denmark (+21%) and Ireland (+25%).

Source: Planet Retail, BCG

This growth can be attributed to several factors, such as a slow comeback from the 2008 recession or the fact that millennials, who have significant buying power, are shopping at more discount stores. But the main driver behind discounters’ rapid growth is that they are investing in their stores to improve the customer experience. In Ireland, major German-based discounter Lidl is investing €550M over the next 3 years to build 20 new stores and upgrade another 24 existing stores. In Sweden, they opened a “green store” with solar panels and charging stations for electric cars and bikes. And, during the early stages of the Covid-19 pandemic, they upgraded the air filtration system in their US stores to make employees and customers feel safer when working or shopping.

US-based grocery giant Wakefern is also investing in redesigning their stores for their discount chain, ‘Price Rite,’ by adding whitewashed walls to make the stores more appealing and pleasant for shoppers. But they aren’t stopping there – they are also improving their offerings. When Wakefern launched ‘Price Rite’ in 1995, there was one major feature missing that would pop out to its current loyal customers – there was no produce section. Today, the fresh fruits and vegetables section is a staple and “centerpiece” in Price Rite’s new stores, and this addition has been credited with bringing more repeat customers.

Pain points are amplified for discount grocery

Discount grocery store shoppers have the same pain points as traditional grocery stores, but they are oftentimes amplified. The culture of discount shoppers is also different; their goals are one of the following: to shop on a budget, to shop for a week’s worth of groceries, or to buy in bulk. Let’s take two of Nielsen’s top grocery shopper frustrations for example – long lines and out-of-stocks. These pain points are magnified for discount grocery shoppers, but they also make room for innovation that will help discounters further improve the customer experience.

Let’s dive into why.

Facing the number one pain point – checkout queues

The reigning number one frustration that grocery store shoppers complain about is the long checkout lines. This is particularly true for discount grocery stores, where people are buying in bulk and the lines are naturally longer because of the larger basket size per person – even small discount stores serve as full-service supermarkets for shoppers. In addition to this, one of the ways some discount grocers lower prices is by having less staff. Especially during peak hours, this creates long lines because there are fewer employees manning the cashiers.

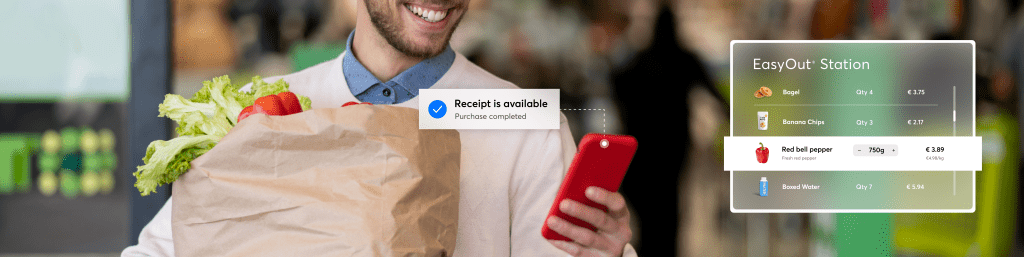

This is one of the reasons that discount grocers are primed for frictionless checkout tech. By eliminating checkout lines, they can reallocate their manpower towards customer service roles and restocking, providing shoppers with an even better experience, one they would expect to find at a high-end grocery store. The more discount grocers close the gap on offerings with their counterparts – whether it be product or experiential – the more customers they will snatch up.

Out-of-stock, out-of-mind

Another main pain point for shoppers is out-of-stocks. For discount shoppers, who go to buy in bulk, save, or do a week’s worth of grocery shopping, arriving at the grocery store and finding that necessary items are out-of-stock can seriously impact their customer experience and satisfaction. To buy an alternative at the price point or volume that a discounter offers requires a much larger effort than for those doing smaller shopping trips.

Solutions in the frictionless checkout space are beginning to offer more than just seamless checkout options, such as Trigo’s StoreOS™, which offers a suite of apps that include inventory management. This helps retailers better handle out-of-stocks by alerting them in real-time when a product is running low or can even provide analytics on when to order certain items that are typically bought at high volumes during different seasons or days of the week. By giving discounters these rich data tools and insights into their inventory, they can make sure there are more items on the shelf and, as a result, keep their customers happy and coming back.

Discounters are already adopting frictionless checkout

If there is concern that there won’t be interest from discounters, the opposite is true – they are already jumping on board. Netto Marken-Discount already has a fully operational hybrid checkout-free supermarket powered by Trigo in Munich, Germany. Discount retail giant Aldi Nord is also working to open a Trigo-powered in Utrecht sometime in 2022. Discounters are building their momentum in the grocery retail space and adopting frictionless checkout is taking them to the next stage in their transformation, and, more importantly, in taking a larger bite out of the grocery market share.