In this tight labor market, retailers use automation to optimize their workforce

Labor retention is a consistent and costly challenge for brick-and-mortar retailers, who are forced to refill more than half of their in-store positions every year on average. The best retail automation solutions streamline store operations, including workforce management, and can help retailers combat attrition, worker dissatisfaction, and mounting labor costs. Let’s review the challenge and solution.

Retail frontline workers are looking to quit their jobs at double the rate of other workers, according to the U.S. Department of Labor. A recent McKinsey report found that nearly half of frontline retail employees and two-thirds of managers are considering immediate job changes. This is not a new problem, as annual employee turnover among frontline retail workers has been at least 60% for a long time, according to McKinsey. But while the greater labor market has stabilized somewhat from the “Great Resignation” trend recorded in 2021 and 2022, retail is lagging, and demand for labor is still a priority many retailers are willing to invest in heavily.

Against the backdrop of a complex economic environment overcast by a global recession, inflation, and supply chain challenges, retailers such as Walmart, Home Depot, and Kroger are spending more to raise wages, hoping to “hoard” employees to ensure their operations run smoothly. To escape this “vicious circle” of competitive hiring tactics, dissatisfied employees, and perpetual restaffing, retail labor rules and assumptions are due a paradigm shift.

Shifting retail’s people model

Retail automation technologies are typically built to remove friction from the shopping journey and deliver competitive, and more delightful experiences to customers. Many of these technologies also reduce retailers’ dependency on certain types of labor, typically the kind of menial, low-skill jobs seeing high levels of burnout and turnover.

According to PWC, approximately 30-40% of store labor costs are checkout-related. By allocating this investment towards better customer service and stock availability, or by rolling it into price reductions, PWC says retailers can see a 20% uplift in basket fill and reduce waste by 0.5%, increasing topline revenue.

Scan-as-you-go and self-checkout counters are some of the innovations that entered stores in recent years to reduce wait times and automate cashier jobs. Self-checkout terminals have become so mainstream that in 2022, they accounted for 55% of grocery transactions in the U.S. While these technologies have a demonstrated impact on checkout lines and labor costs, they fall short in terms of the shopper experience. Both scan-and-go and self-checkout essentially shift liability from the cashier to the customer and still maintain a certain level of friction. What’s more, these methods are shown to increase shrinkage considerably.

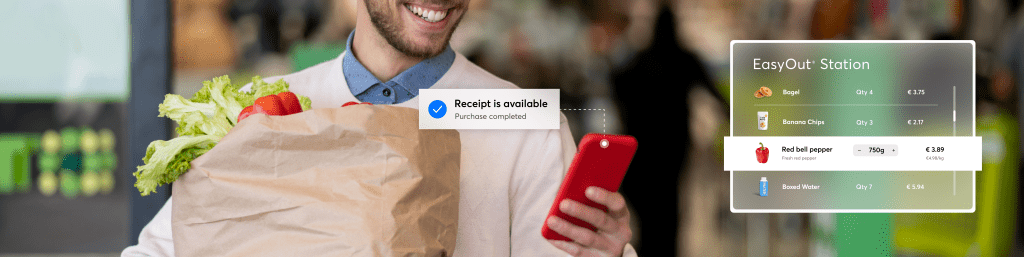

Full store automation powered by computer vision technology removes friction from the shopping journey altogether, while also providing the retailer with a new level of control over store operations. Computer vision technology captures each interaction shoppers have with the products, reducing shrinkage to a minimum, while the rich data insights produced by such technology go on to power data-driven stock management and other revenue-growing activities. Such an approach to automation opens the door to new experiences, and new roles, within the store.

As store automation lessens retailers’ dependency on low-impact jobs that have little contribution to growth, such as cashier jobs, labor can be reallocated toward higher-value and higher-skill tasks that enhance the customer experience. These tasks include customer service, inventory management, and food preparation. Upskilling and additional employment opportunities tend to support better employee fulfillment and could lead to a lower turnover rate.

McKinsey forecasts a major shift in retail’s people model. Emerging experience-focused roles will increase the demand for different skills—such as social-emotional skills and advanced analytical and technical skills. Winning the future retail landscape will depend greatly on sourcing and attracting the right talent. According to McKinsey, retailers may want to adjust their people models to strategically plan and acquire the required skills for the next three to five years, ensure workforce retention, and offer a robust reskilling program.

The good news is that shoppers are embracing store automation. A PWC survey of 5,000 UK adults found that 1 in 2 shoppers will actively switch to frictionless retail experiences. Consumers consistently place convenience as a key factor in deciding where to shop with 41% of all consumers saying that they would pay more for greater convenience. Within the next 10-15 years the majority of UK shoppers will be seeking a frictionless shopping experience, or more accurately, will be exposed to a frictionless experience at some point during the day.

Beyond the labor challenge, opportunities for data-driven growth

According to PWC, the rich data insights delivered by digitized store environments open the door to significant margin-optimization activities, from streamlining workforces and optimizing stock management to more strategic store design. Shoppers in these automated stores can expect to enjoy improved product ranges and better-targeted, more personalized promotions. And, as retailers better understand customer behaviors and journeys, store layouts will become better and easier to navigate.

Trigo transforms grocery retailing. We leverage computer vision technologies together with off-the-shelf hardware to retrofit traditional stores of all sizes, transforming them into autonomous stores. We apply proprietary algorithms to ceiling-mounted cameras and shelf sensors to create a 3D image of a store. This digital environment automatically learns and processes data on shoppers’ movements and product choices in real-time, with a privacy-by-design architecture that ensures no biometric or facial recognition data are gathered or analyzed.

Our solution delivers data that drives operational efficiency: enabling predictive inventory management to reduce waste and out-of-stock, while strengthening retailers’ response to a tricky supply chain; it supports a more sustainable store by enabling smart pricing; it optimizes store labor, allocating workforce towards more impactful jobs; it maximizes store revenue with improved, data-driven planograms and by enabling event-based marketing. The cost-cutting and revenue optimization supported by Trigo’s technology enables grocery retailers to remain competitive and keep prices low during tumultuous economic times.

To learn more about store automation, book a quick call.